You must have wondered how exactly the payments are processed when you swipe your debit/credit cards at the retail store for payment or submit your credit card details during the checkout process online. In this post, we’ll share the complete process on what happens after you swipe your credit card.

Life-Cycle of Credit Card Payment

Customer:Customer may want to shop for products at a mall or retail store. While some are ready to make the payment through cash, others prefer credit cards. They need to swipe their card on a machine to initiate the transaction.

Issuing Bank: The financial institution that has issued your credit card is known as the issuing bank.

Step 1: Acquiring bank

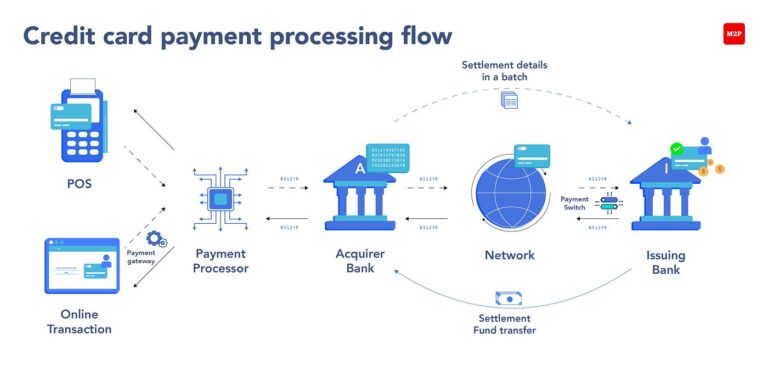

As soon as you swipe the credit card physically or submit the credit card information on a website, the payment is transferred to the vendor’s account. The recipient of the transaction is known as the acquiring bank.

Step 2: Authorization

The acquiring bank sends the information available on the credit card to the card company such as Visa, American Express, and MasterCard. The process is carried out to determine the issuing bank.

When the customer swipes a credit card at the store, it sets an authentication procedure to verify that an appropriate amount is charged for the merchandise purchased from the store.

Step 3: Authorization Block

Once the card company receives the verification requests, it confirms with the card-issuing bank whether the bank accepts a certain amount of transaction from the particular customer. Once the issuing bank has verified the transaction, the requested amount is placed on hold. This step is known as the authorization block.

Step 4: Confirmation

After receiving confirmation from the issuing bank, the card company confirms the transaction approval to the acquiring bank.

Step 5: Transaction Approved

After the verification process is over, the acquiring bank sends a confirmation to the card company and approves the transaction.

As much as time-consuming and difficult the process seems, it happens in a matter of minutes. you don’t need to wait for hours at the store to get your transaction approved. In this process, your card company sends the transaction request to the issuing bank and verifies the details to initiate the transaction. Interestingly, credit card works even if the acquiring and issuing banks are located in two different corners of the world.

Settlement

The next part is the settlement, which involves the management of the transaction amount according to the merchandise purchased. Let’s have a look at the settlement process and how it executed.

- Vendor’s End of Day

At the end of the day, the vendor accumulates all the transaction details and shares it with the acquiring bank. All merchants need to share the complete transaction list to the acquiring bank by the end of the day.

- Net Settlement

After receiving the transaction details, the acquiring bank is responsible for communicating this information to the credit card companies like MasterCard and Visa. The credit card companies gather the information and provide the info concerning the net settlement of the acquiring bank with the issuing bank.

Note that the net settlement is calculated by the credit card companies between the acquiring and issuing organizations. After calculating the net settlement, the credit card company sends the message to the issuing bank stating that they owe a specific amount to the acquiring bank. Basically, it is the duty of the card companies to ensure that all the transactions are settled.

Interchange – Deducting the Interchange Fee

There is a specific interchange fee charged for all possible transactions made through credit cards. Let’s say customer purchases merchandise for Dh200. The Credit Card company will message the issuing bank that they owe Dh196 to the acquiring bank. The difference in the amount is referred to as interchange.

The interchange is the fraction of fee that the card company charges for allowing the merchant to use the particular card at their store. But that’s not it! The merchant will receive DH194.8 in their bank account. The rest of the amount is used by the acquiring bank as fee (also known as the acquirer’s fee). This way the interchange process works. A fraction of the amount is kept by the credit card company and the acquiring bank, while the rest is transferred to the merchant’s account.

Transaction on Customer’s Statement

As soon as the issuing bank receives the transaction request from the Card Company, it displays the transaction on the user’s bank statement with the message “you owe Dh200 and here are the additional rewards”. For using the technology, giving rewards, managing the authorization and net settlement, and verifying the transaction, the two percent of interchange fee is charged in total.

The question is ‘how does it benefit the merchant’ after all the merchant has to pay a 2% interchange fee for each transaction? Well, the electronic payments are far better than cash payments. Merchants no longer need to bear the risk of holding a significant amount of money at the store. Moreover, they don’t have to go through the burden of passing entries or settling transactions. Everything is handled by the card company and acquiring a bank.

Indeed, credit card payment brings together many intermediaries to process the transaction and settle the funds. The surprising fact is that approx 131.2 billion card transactions were reported in the United States in 2018. Amongst this, 124.3 billion transactions contributed to the Visa Card Network.

Additional Players in the Process

The intermediaries who play a major role in payment processing are:

- Authentication Service Provider: They are the mediators appointed by each bank. They are responsible for the authentication of the credit card details on the bank’s behalf if the payment is processed online. Basically, these companies verify the user’s details by confirming the One Time Password the customers submit. They are responsible for managing the authentication for hundreds of banks.

- Payment Gateways: Payment Gateways connect the vendor’s site to a safe and secure transaction page. It provides the customers with a secure page, where they are supposed to enter the credit card number and other details safely.

- Payment Service Providers: The intermediaries who offer other basic services during the online transaction are referred to as the payment service providers. These companies are responsible for offering technology that directs the transactions. They allow merchants to accept payment in different forms such as QR Codes, AliPay, PayPal, etc.

- Authentication processor: They are the servers that work as translators between banks and payment gateways. Authorization processors capture the encrypted data and share the information with the partner appointed by the authorizing bank.

Security

The whole system runs without the involvement of the human. The checks and controls test the security and encryption to ensure that everything is processed in a safe manner.

Why Don’t You Get OTP Sometimes?

Whether or not you receive an OTP for authentication depends on the merchant. If the merchant believes there can be a risk of fraudulent transactions, they will implement the OTP authentication. However, some merchants prefer to avoid such authentication as it slows down the whole transaction process. The merchants are liable for any fraudulent activities if they don’t offer a secure payment channel. Banks need to issue a 3D compliant card so that a safe transaction takes place with the secure payment channel.

How Issuing Bank Charges the Customer?

The issuing bank has to prepare a bank statement on a specific date every month. The statement displays all the card transactions that take place before the given date. The bank mentions the payment date, which could be the 15th or 25th of every month. Customers making the payment within the given duration are charged 0% interest. But, if you exceed the deadline, the interest on the payment will be imposed by the issuing bank.