Financial technology, also known as fintech has completely revolutionized how we manage our money covering everything from transactions, to financial planning. The foundation behind this transformation lies in the creation of a robust and adaptable system design. In this blog post we will explore the concepts involved in constructing a fintech platform providing real life examples to guide you through the process.

1. Scalability: Preparing for Growth

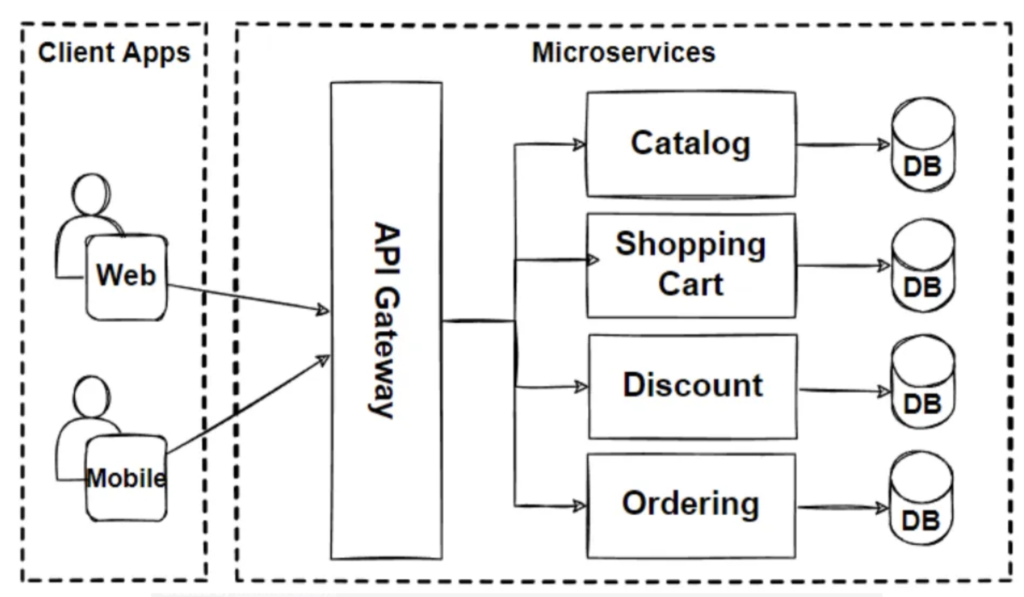

When building a fintech platform it is crucial to consider its ability to handle growth effectively – be it an increase in users, transactions or data volume. To illustrate this point lets take PayPal as an example. PayPal successfully processes millions of transactions each day by utilizing a microservices architecture that allows individual components of its system to scale independently.

Key Takeaway:

To ensure your platform can seamlessly grow with demand over time it is essential to invest in an architecture from the start. Utilize resources like microservices, cloud computing capabilities and load balancing techniques as allies.

2. Security: Safeguarding Financial Data

In the realm of fintech security takes precedence above all else. As users entrust their information to your platform any breach can have consequences. Stripe. One of the leading payment processing giants. Places importance on end to end encryption measures along with security audits and even operates a bug bounty program to maintain an uncompromising security posture.

Key Takeaway:

Make security your top priority, across all layers of your system; whether it’s data transmission or safeguarding information.

Regularly conducting audits and taking a stance, in identifying and addressing vulnerabilities are crucial.

3. Reliability: Ensuring Uptime and Consistency

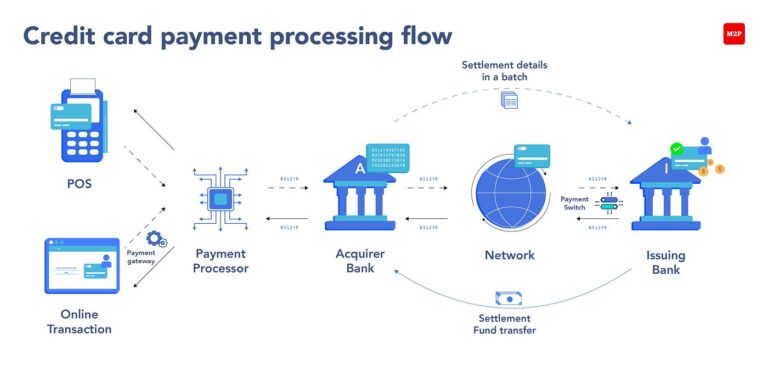

When it comes to fintech platforms reliability is key. Users rely on the accuracy and promptness of their transactions. Square, renowned for its point of sale (POS) system maintains reliability by employing systems, real time monitoring and automated failovers.

Key Takeaway:

Invest in redundancy and monitoring to ensure that your platform is always available and performing optimally. Reliability builds trust, which is crucial in the financial industry.

4. Latency: Keeping It Snappy

Low latency is crucial for a fintech platform. Users expect immediate responses, especially for transaction-related queries. Robinhood, a popular investment app, leverages a combination of in-memory databases, content delivery networks (CDNs), and optimized algorithms to ensure low-latency operations.

Key Takeaway:

Optimize your database queries, leverage CDNs, and scrutinize your algorithms to minimize latency. A fast platform enhances user experience and engagement.

5. Compliance and Regulation: Navigating the Legal Landscape

Fintech operates in a heavily regulated environment. Adherence to laws and standards is non-negotiable. Revolut, a digital banking app, navigates this landscape by having dedicated compliance teams and employing advanced technologies like machine learning for fraud detection and anti-money laundering (AML) checks.

Key Takeaway:

Stay informed about the regulatory landscape and invest in compliance. Automation can be a powerful tool in ensuring adherence to legal standards.

6. Data Handling and Analytics: Turning Data into Insights

Data is the lifeblood of fintech. Platforms like Mint use user financial data to provide personalized insights and recommendations. This requires a robust data warehousing solution and advanced analytics capabilities.

Key Takeaway:

Invest in a solid data warehousing solution and analytics tools. Use data responsibly and transparently, providing value back to the user in the form of insights and recommendations.

7. User Experience: Designing for Simplicity and Clarity

A fintech platform’s user interface must be intuitive. Venmo excels in this area, offering a social, easy-to-navigate app that has attracted millions of users.

Key Takeaway:

Invest in user experience (UX) design. A user-friendly platform fosters adoption and customer satisfaction.

Conclusion: Building for the Future

Building a fintech platform is a challenging but rewarding endeavor. By focusing on scalability, security, reliability, low latency, compliance, data handling, and user experience, you set the foundation for a successful, resilient platform.

Learn from industry giants, but remember that each platform is unique. Tailor these concepts to fit your specific needs and user base, always keeping an eye on innovation and user satisfaction. The future of finance is digital, and with the right system design, your platform can be at the forefront of this revolution.