In this digital world, the world’s most popular blockchain platform- Ethereum is all set to witness a radical change. According to the media reports, the Ethereum platform will merge the Ethereum Mainnet with the Beacon Chain, marking a transition from proof-of-work to proof-of-stake. Post the Merge, Ethereum would become a lot greener, leaving Bitcoin as the only leading blockchain that still relies on proof-of-work. According to Ethereum Foundation, Ethereum’s energy consumption is expected to reduce by 99.95% post the Merge.

The merge will immediately improve Ethereum’s speed, sustainability, and scalability to Ethereum’s network. The Merge is scheduled for the 19th of September 2022, but the date could change based on the success of the final testnet merge, client refinements, and the hashrate of the present miners.

The “Merge,” will be the end of the proof-of-work Ethereum and give birth to Ethereum 2.0, the version based on a proof-of-stake consensus algorithm.

Why The Merge?

In the era, when we all look for ways to reduce carbon emissions, coins like bitcoin and ether consume huge amounts of electricity. When in the present world, more people are concerned about climate change, and saving the climate has become their top-most priority, the carbon emissions of bitcoin and Ethereum are too conspicuous to ignore.

In the Merge, Ethereum will deploy a new system named proof of stake, which has been planned many times earlier as well. But due to technical complexity, and the higher cost, the Merge has been delayed multiple times. According to Ethereum co-creator Vitalik Buterin, the company has been working on a proof of stake for almost seven years now, and now all the hard work is getting paid off.

What is the significance of the merge?

To help readers under this transition, the Ethereum Foundation uses an analogy comparing Ethereum to a spaceship in mid-flight. The community has designed a new and better engine post all the testing. This is the new engine, more advanced, which will merge the new, more efficient engine into the existing ship.

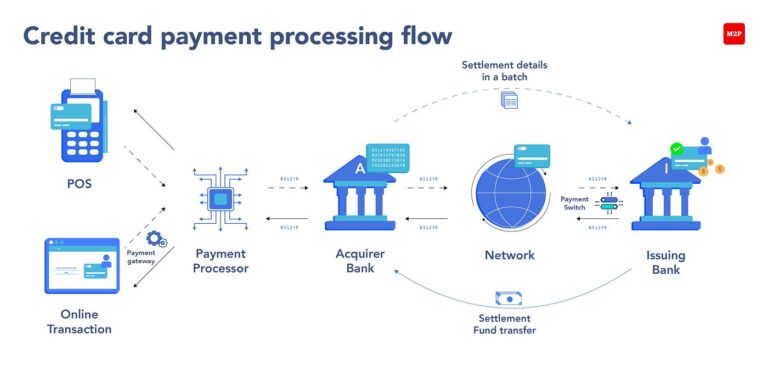

Also, since Ethereum’s inception in 2015, the company has been using a system named proof-of-work to securely add new transactions and other information. Proof-of-work requires user computers to solve difficult computations before being allowed to add a new block. Many cryptocurrencies including Bitcoin use this method, known as mining. Though Mining is completely secure, it’s also energy-intensive. Ethereum proof-of-work consumes the same amount of energy annually as some countries consume the same in the entire time frame.

However, proof-of-stake is an alternative, which consumes less energy. Rather than consuming electricity, which fuels computing power, the users looking to be a part of the verification process will put their personal cryptocurrency on the line in a process named staking. These users or validators will be selected randomly to verify new information to be added to a block. They will get cryptocurrency in case they have provided accurate information. The ones producing false information will lose their stake.

How the merge would work

The vital technology backing the merge is the “Beacon chain” — a proof-of-stake ledger of accounts that has been adding and verifying transactions distinct from Mainnet since its inception in 2020 end. If both accounts merge, the information from Mainnet will be transferred to the Beacon chain, resulting in significant energy savings.

Conclusion

Ethereum is certainly big news for the crypto world, but the main concern here is whether Ethereum will become widely accepted for real-life uses and not merely as a vehicle for traders. The users planning to place their bets on a highly speculative and highly touted asset must be prepared to lose a significant portion of their money, if not all of it, due to the risky nature of the crypto market.

No matter how risky the crypto world is, one thing is for sure, that is The Merge as soon as possible. The merge will end the proof-of-work for Ethereum and a new era of a more sustainable, eco-friendly Ethereum will begin.